The talking heads in the financial media and by default, most retail investors, are very concerned about interest rates rising. We would agree that Treasury rates are low as they have been supported by the Fed's massive quantitative easing program.

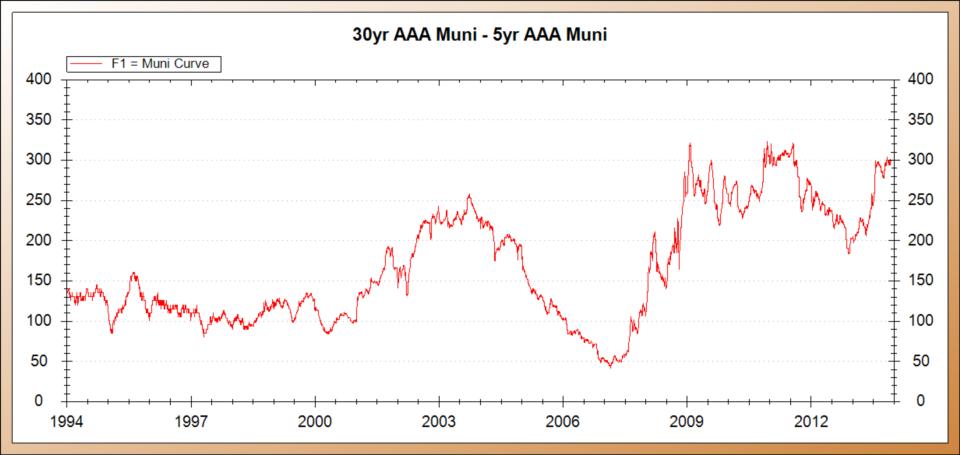

The muni market, on the other hand, has seen massive amounts of fund liquidations especially in the long end. The muni curve is now extremely steep which implies that the market anticipates higher rates in the future. In fact, there have not been many other times in history where the curve has been this steep.

AAA 5yr yld = 1.20

AAA 30yr yld = 4.20

In the double AA space the curve is even steeper; 5yr at 1.50 and 30yr at 5.00.

We believe duration is cheap and that clients should be considering adding long duration paper at 5% or better yields.

Please call with any questions.