NOTICE:

On March 13, 2020 the SEC issued an Order

providing a 30-day relief period regarding the annual amendment update filing

deadline for registered investment advisers. The filing deadline each

year is no later than 120 days subsequent to year-end (eg by March 31,

2020). The 30-day relief period was further extended on March 25, 2020 by

a second Order pushing the filing deadline this year to June 30, 2020.

Registered investment adviser, ASA Managed Account Managers LLC and relying

adviser, TF Managers LLC (collectively, “ASA”), did not file its annual

amendment update by March 31, 2020 due circumstances created by COVID-19.

ASA is working during the relief period to get the annual amendment update filed

and anticipates doing so by May 15, 2020.The Current Lending Environment

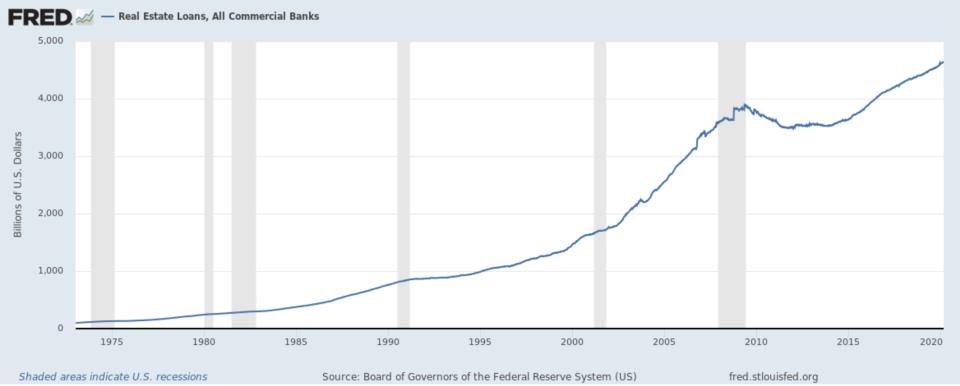

Since the financial crisis of 2008, the lending environment has been challenging, primarily for smaller borrowers who are not able to access the capital markets. Further, bank lending was, for some time, more restrictive than prior to '08, though it has been supported significantly by Federal Reserve stimulus and has become much easier in recent years. Still, there are a large number of loans that are maturing or that are in need of restructuring from the 2005-07 period. In many of these cases, banks do not want to extend these loans, and the borrowers may not fit the criteria for any kind of government funding. Additionally, accessing credit through the Small Business Administration (SBA) is very cumbersome particularly if there is a blemish on a borrower's credit history. Finally, there are always borrowers who simply don't present well, have no borrowing history, or are in a situation where 'time is of the essence.' Nonetheless, in all these categories, there are borrowers with valuable collateral that can secure loans which serve as a 'bridge' to lower cost, longer-term financing or a sale in 1-2 years.

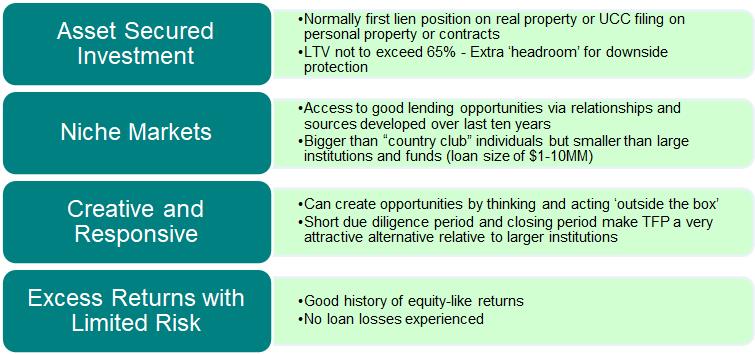

Transitional Funding Partners L.P. (“TFP”), managed by TF Managers LLC (the “Adviser”), focuses on these types of loans and borrowers. TFP is largely a Sr. secured lender designed for those seeking high current income. The primary objective of the Fund is to maximize total return while maintaining a moderate risk profile. The Fund will also seek to minimize taxes when possible.The Fund invests substantially all of its assets in Sr. lien private loans secured by residential and small commercial real estate or other hard assets which can be valued and liquidated in an orderly way. Loan maturities are primarily 1-3 years. Loan yields are generally 7-15%, though returns may be greater than or less than the stated yield. The real estate leverage super cycle has been large, and particularly in commercial real estate, has only reaccelerated in the recent past. While this has temporarily compressed yields, we believe the table is now set for another credit cycle in which strong opportunities will persist until the full deleveraging cycle plays out over the next several years.

TFP Advantages

Transitional Funding Partners offers investors a unique opportunity to obtain excess returns secured by string collateral with potential upside options under certain scenarios.

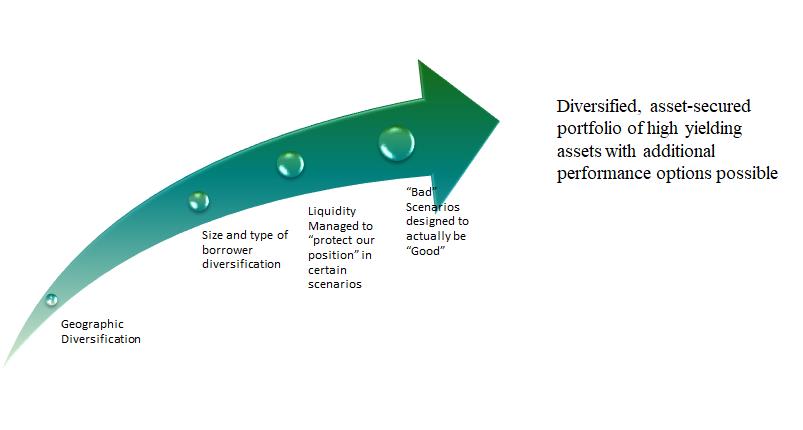

Portfolio Construction

Transitional Funding Partners will continue to build a loan portfolio that is diversified geographically (within the United States), by borrower, and by collateral type. At critical mass, no more than twenty percent of the Fund's capital will be exposed to any specific risk. All loans will be secured by mortgages, deeds of trust, UCC filings, and/or tax liens. Additionally, liquidity will be closely managed to provide regular cash flow to the fund in

TFP Loan Sourcing

TFP has a diverse group of sources through which it originates or acquires loans:

- National broker/dealer originator network, which includes loan brokers, investment bankers, real estate professionals and smaller banks

- Loan sales or auctions

- Word-of-mouth direct inquiry from potential borrowers

Relative Yield Summary

Private, whole loans and factoring provide much higher yield and better security than do other available fixed income assets.

Source: Barclays Capital (Coupon or One

year returns)