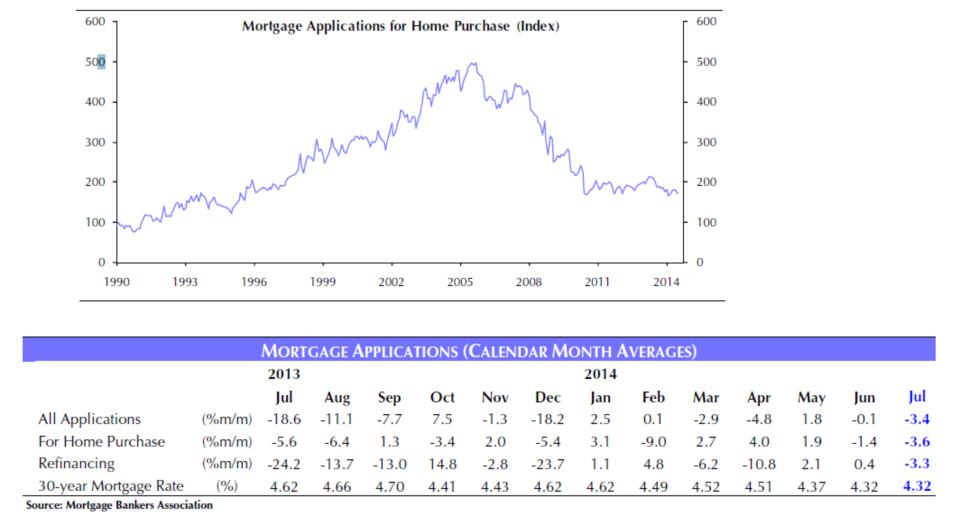

The most recent Fed Senior Loan Officer Survey implied mildly easier lending conditions and stronger demand for C&I loans. The survey also seemed to indicate strengthening demand for mortgages with a net balance of 45% of banks reporting a rise in mortgage demand. It is bewildering then that the very next day the Mortgage Bankers Association reported that total mortgage applications fell by 3.4% in July and that applications have contracted for four of the past five months. Some of this could be explained by a slow down in refis. However, easier lending standards and still very good affordability make the decline in applications for home purchases a puzzle. Could it be that we have stimulated all the "cheap money" housing activity possible over the last thirty years and are now hitting the zero barrier limit to stimulating this economic activity?