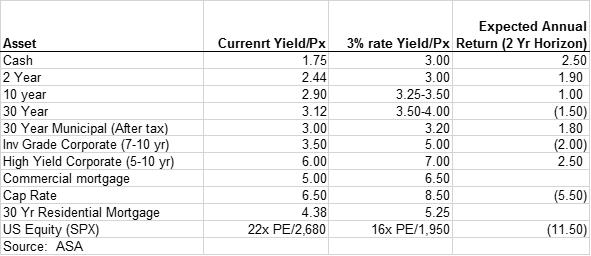

While the path which assets take to get to 'fair' valuation is very difficult to predict, and not always mathematically rational, we can hazard a guess as to what asset prices/expected returns might look like with a three percent risk free rate (100 basis points of tightening after the assumed 25 in June):

Bottom line: Expected future returns in the medium-term look unexciting at best. Any return is going to have to come from 'alpha' or some form of idiosyncratic risk rather than from broader market return. That implies to us a very cautious stance with time focused on finding hidden gems (which are fewer and farther between), small relative value trades, and enhancing returns on cash while keeping in the back of our minds that sometimes doing nothing is the best thing to do!