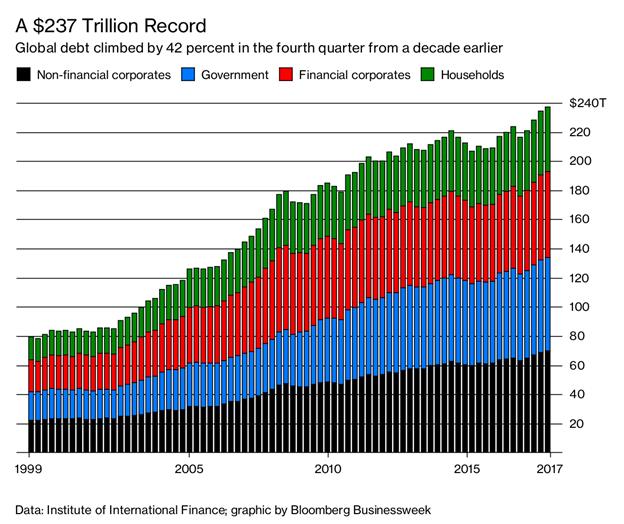

Global debt has tripled since the turn of the Century:

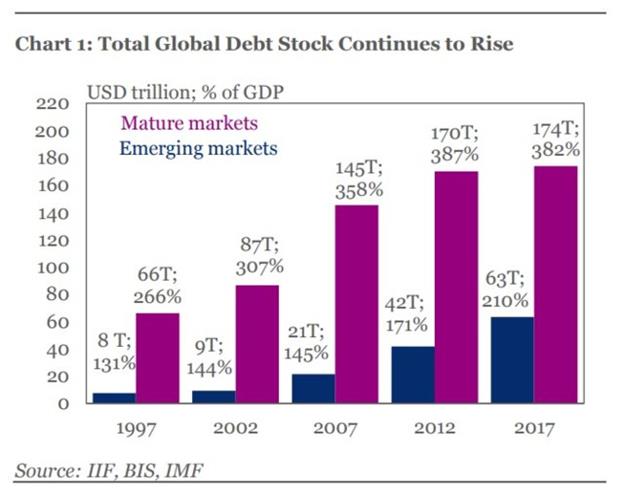

The good news is that US GDP has doubled in that same time frame. Further, most of the debt growth happened up to 2012 whereas much of the economic growth happened from 2010 to the present. Consequently, US Debt/GDP has actually declined slightly in the past 5 years. This is not the case in emerging markets with China leading the debt binge:

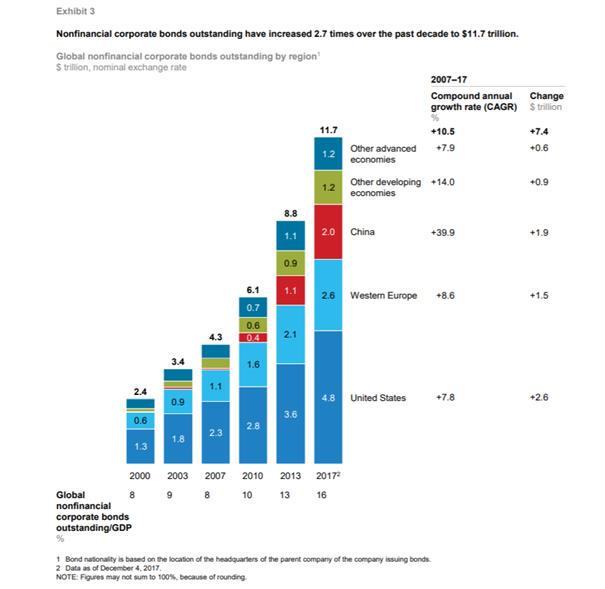

As you can see, most of the debt growth since the crisis era has been concentrated in government and corporate debt. Consumer debt growth, with the exception of student loan debt, which has grown by about 440% since 2004, has been relatively subdued. Finally, and most interesting to us, we note that residential mortgage debt growth has been minimal, though it has picked up modestly of late. Conversely, commercial borrowing has expanded much more rapidly at about a 7-8% annual clip over the past five years. Multifamily is the fastest growing sector of commercial real estate debt at just over 10% annual growth.

Conclusions: No deleveraging has happened globally. To the contrary, debt as a percentage of GDP is hovering at all time highs of about 325%. This will not be sustainable in a non-zero interest rate environment. The next crisis will bring greatest pain in the sovereign and corporate sectors where debt levels are least sustainable. Multi-family is probably most vulnerable in the real estate sector...and it is hard to predict how the student loan complex will work its way through the next downturn without some form of debt forgiveness (not currently contemplated) or government bail out.