Puerto Rico Trip 6/3 thru 6/5

The media doomsayers have publicized the obvious problems of slow growth, high unemployment, and a shrinking population. During our visit, we met with the two top economists on the Island; Dr Juan Lara and Carlos and Carlos Colon De Armas, both from the University of Puerto Rico. In addition we met with the Executive Director of Tourism, the Pharmaceutical Industry Association, the Department of Economic Development, two private real estate/bank consultants, and two legislators (Hernandez - President of Treasury and Budget Committee, Bhatia - Senate Leader) to figure out the following:

- Is the economic downturn cyclical or structural

- Why is the labor participation rate so low

- What happened to all of the jobs

- What is being done to attract new jobs

- Which credits are safe

Cyclical downturn? No! The down turn is not cyclical, the economy has structural barriers to growth which has prevented the PR economy from recovering.

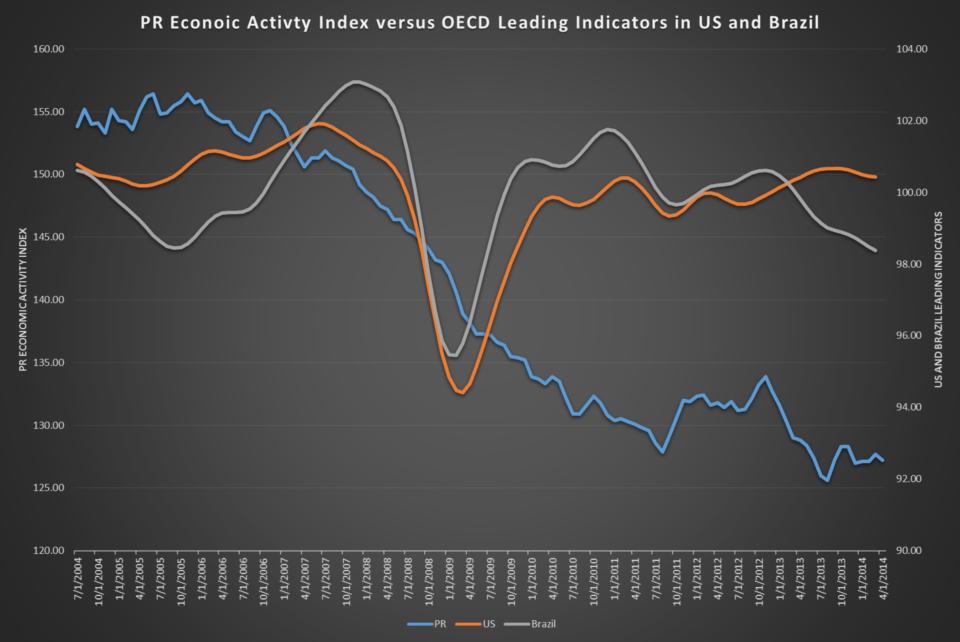

The Economic Activity Index is a closely monitored index that summarizes four major indicators in Puerto Rico; non-farm payroll, cement sales, gasoline consumption, and electric power consumption. The OECD leading indicator index is a similar measure used to gauge economic activity in developed countries (not States or Territories).

The chart below shows the Puerto Rico Activity Index (GDB source for data) on the left axis and the US and Brazil leading indicators (OECD source for data) on the right. US and Brazil activity has returned to pre bubble levels but Puerto Rico economic activity has stabilized but has not recovered like US and Brazil.

Why such a low labor participation rate? The low participation rate is a function of attractive benefits, high personal income tax rates, and federal minimum wages; all resulting in a flourishing underground economy.

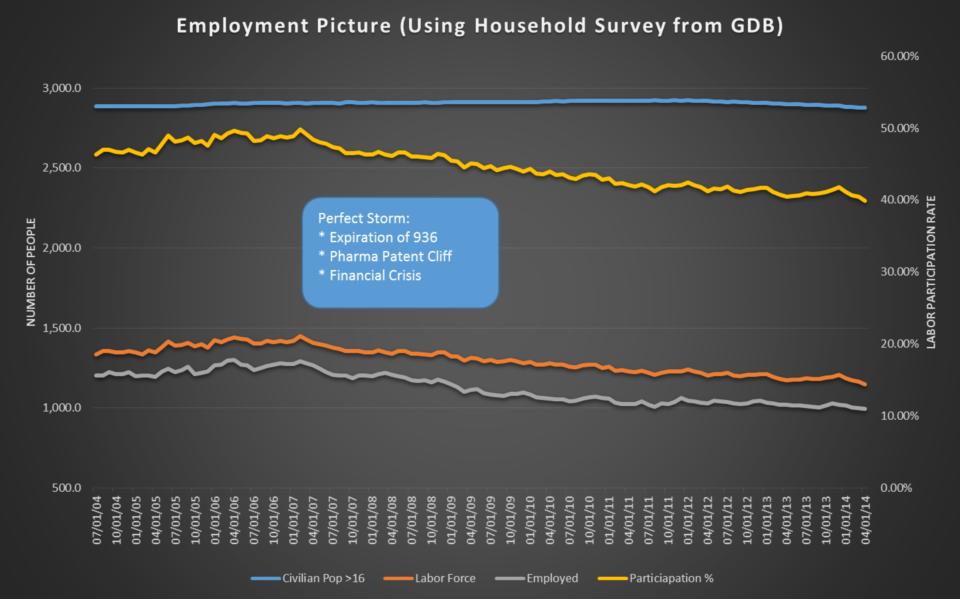

The graph below paints a very telling picture. With the civilian population (blue) staying steady and the labor force (orange) dropping, the resulting participation rate (labor/civilian) is now 39%, meaning that only 39% of the civilian population (over 16) is participating in the job market, a staggering figure, especially considering that 63% of the US labor force participates.

Dr Juan Lara, suggested that there were many reasons for this low participation rate and low incentive to work; lucrative government subsidies relative to low salaries, high income tax rates, and federal minimum wage laws restricting wages from falling to competitive levels. All of these factors encourage growth in the underground economy.

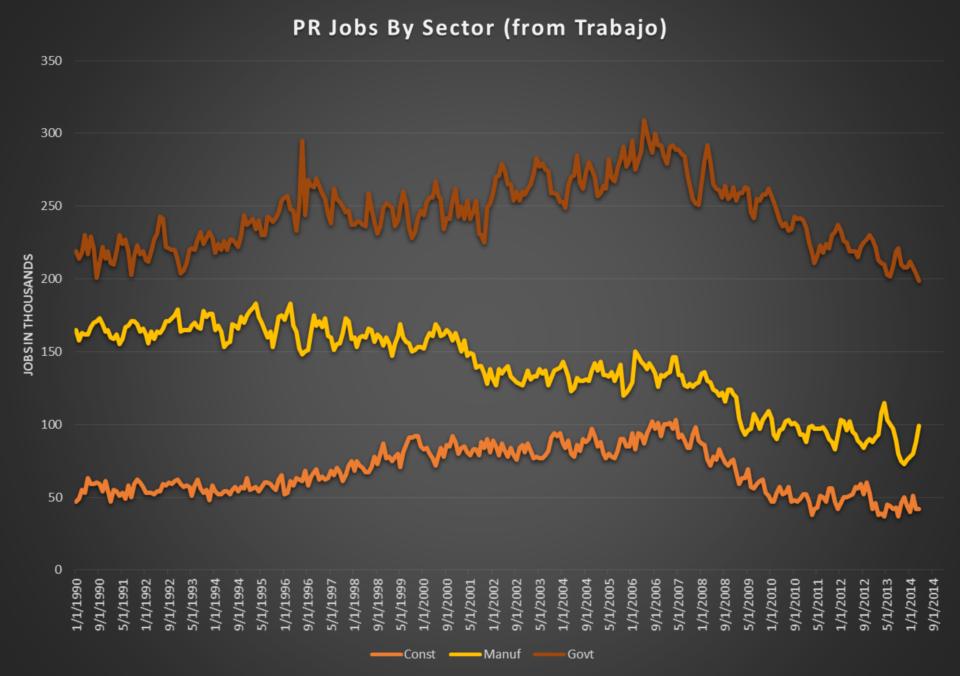

What happened to all of the jobs? A "perfect storm" has resulted in consolidation of the manufacturing, construction, and gov't labor forces.

Historically, US firms operating in Puerto Rico have been exempt from Puerto Rican and US corporate tax. The Tax Reform Act of 1976 and specifically section 936 enabled US corporations to receive a federal tax credit for income derived from Puerto Rican operations. Many manufacturing companies, especially those concerned with quality control and IP protection invested in Puerto Rico; pharmaceuticals and medical device manufacturers in particular. To that end, manufacturing accounted for almost 50% of GDP, with heavy concentrations in pharma.

In 1996, President Bill Clinton, under pressure to balance the budget and keep more jobs on the mainland, terminated section 936 and expired the tax benefits in 2006. Given the high cost of electricity and labor relative to alternative production sites in Mexico and China, many of the low cost manufacturers moved off Island.

Those manufacturers (Pharmaceuticals and Medical Device) that benefited from the skilled labor, qualified production sites, and the IP protection stayed on Island but they suffered from other problems. Starting in 2007, the patents on many of the blockbuster drugs started to expire ("Patent Cliff"). Estimates of as much as 100 billion in annual sales have been lost to generics since 2007 and the pharmaceutical companies continue to close plants and cut costs to maintain margins.

Puerto Rico was caught in a perfect storm; termination of the tax benefits hurt manufacturing employment, the "patent cliff" forced consolidation in some of Puerto Rico's largest employers, and the US recession stalled tourism and real estate development. The graph below shows the job growth in each major sector of the economy. We can see that manufacturing, construction, and gov't job growth fell considerably.

According to Carlos Bonilla from the Puerto Rico Manufacturers Association, the number of direct jobs in all manufacturing industries have decreased from 155k to 80k at present. The number of indirect and supporting jobs is estimated at a 3 to 1 factor; resulting in 225k in losses. To put things in perspective, there are approximately 800,000 private sector jobs in PR, so the manufacturing consolidation has resulted in a loss of approximately 25% of the private sector workforce.

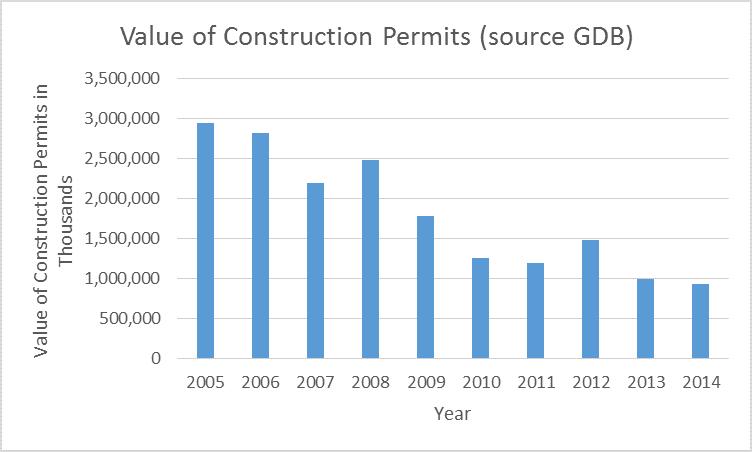

Industry consolidation and job loss has had a ripple effect in the economy. Without higher paying jobs, the best and the brightest are leaving the Island for better opportunities. As they leave, they need to sell their homes and new construction is put on hold. The value of real estate also falls as there is less demand and less support from the rising tide of more people as seen in growing economies.

The graph below shows the value of construction permits. Dr Juan Lara, from the University of PR believes that the supply overhang in the low to middle income housing markets has stabilized and that construction spending may begin to pick up.

Source: Government Development Bank (GDB)

One of the bank consultants we spoke to commented on the weak banking sector and made note that the FDIC asset guarantees will be maturing in 2015. Some of these banks may try to sell these assets while still under the guarantee. His point was that the commercial and high end real estate could remain soft until this inventory clears. That being said Act 22 is attracting wealthy individuals to the island that are investing in exactly these types of properties.

What is the gov't doing to attract jobs? The Government has implemented an aggressive marketing effort focusing on "Knowledge Based" industries and Tourism.

We met with Jose Merheb from the Department of Economic Development and Commerce. His department's primary job is to market Puerto Rico to potential employers. Their plan is to focus on businesses that utilize Puerto Rico's natural advantages which include a highly educated and bilingual work force, a unique location or bridge between Spanish speaking South America and the English speaking North America, and all the benefits of being a US territory.

Recently passed Act 20 gives tax incentives to knowledge or service based businesses. The Act reduces the corporate taxes on income to 4%. A recent example is a contract with Lufthansa Technik to establish a major aviation overhaul and repair facility on the old air force base. The company has already signed an agreement with Jet Blue and is working with the engineering school to employ 100 engineers and mechanics.

His Department is targeting medical device, bio tech, and other industries that require quality control and intellectual property protection to replace the downsizing pharmaceutical companies. The facilities are state of the art and meet the quality standards required.

The Department is also trying to bring the "dispara" or those that have left the Island, back home. According to Jose, there are almost 5 million of these types; some have done extremely well financially. Act 22, provides lucrative tax incentives to bring them back to the Island. The Act enables these newly established residents to earn passive income tax free.

The idea is to get these wealthy Puerto Ricans back on Island buying and investing in high end real estate. This is happening; every luxury rental building in San Juan has a waiting list, you can't get a room at the St Regis in Bahia Beach on the weekends because it is booked with families looking for home sites, and all of the houses at the Dorado and Ritz Reserve are sold out. John Paulson and Nicholas Prouty are well known fund managers who are making investments in these properties and considering residence, but they are not the only ones.

We met Ingrid Rocafort, the executive director at the Puerto Rico Tourism Department. She articulated another clear growth plan. Starting with access to the Island, their goal is to make Puerto Rico the gateway to the Caribbean. The airport is large, newly renovated, and nicer than many of the airports on mainland. It was busy!

Seaborne is the largest airline servicing the Caribbean and they are moving their headquarters to San Juan. In addition, Jet Blue and United now have direct flights from Chicago. They emphasized expansion and focus on Spanish speaking tourists and have secured direct flights from Columbia, Brazil, and Mexico. From Europe, direct flights are secured from Spain and Germany. Passenger traffic was up 60,000 people during the Oct to March period relative to the same period the year before.

By sea, the Tourism Department has done well marketing their new Pier 3 infrastructure. With small concessions, they have attracted new cruise lines and required many to do an overnight in their ports. While I was there, there were 3 cruise ships docked and tourists spent the day walking the streets of old San Juan. They are finalizing a deal with Disney who is contemplating an exclusive port and beach destination for their cruises on east side of the Island. Cruise passenger visits are up significantly, up 84% from Aug 12 to Aug 13.

Finally, hotels are also being built and renovated. There are currently over 60 projects in various stages and the goal is to increase the amount of hotel rooms from 15,000 to 20,000 over the next three years. There are 900 rooms being built this year. Interestingly, they are seeing some EB5 investments from China. These investments provide non US investors with the opportunity to attain US visas in exchange for creating jobs.

What is the gov't doing to make the Island more competitive? The gov't is aggressively trying streamline the public corporations and make utility costs more affordable. They are also trying to move towards a consumption based tax system.

In addition to job initiatives and tax incentives (Act20/22) the gov't is addressing the high utility costs. Most of the ex gov't officials that we talked to referred to the inefficiencies and waste in the public corporations. They talked about bus mechanics coming to work 4 hours before the buses even arrived at the stations and then only working overtime hours. They talked about the PREPA billing systems incurring a $ 4.10 charge per bill partly because the paper they bought would mildew in their warehouse before they calculated the bills. Most concerning, they discussed the massive amounts of "leakage" or theft of both electricity and water. Act 1922 or the Fiscal Sustainability Act was passed by the House and the Senate this week and it allows the gov't to break excessive union labor contracts and reduce the amount of waste in the gov't and public corporations.

Tax reform is on its way. The President of the Treasury and Budget (Tatito Hernandez) said that they were working very closely with KPMG on major tax reform. He believes that a comprehensive consumption tax will be introduced in November and passed in December. Most PR economists believe that the consumption tax is business friendly and better suited for an economy with a large underground economy. Political support and passage will be garnered because politicians can run on a platform that eliminates income tax filings for 80% of the tax payers. In addition, the property tax system is outdated as property taxes are based on 1957 valuations.

Tatito was quick to point out that these reforms needed to be passed before year end. He stated that most politicians will focus on their reelection campaigns in the New Year and nothing meaningful will get passed.

Will the budget be balanced? The current administration has made a balanced budget a priority. Don't underestimate the will of this administration and the amount of "fat" that they can and will cut.

Revenues: Analysts and media have spent a lot of time discussing the high tax rates and the validity of Act 154. We believe that in the short term (fiscal 2015) tax rates and receipts will remain unchanged, but starting in November, major tax reform will be introduced and passed.

Below is a table summarizing the major sources of revenue from the 2015 budget estimate, these numbers are in billions and come from the GDB.

Corporate tax collections fell 380 mlln short of estimates in April, which has created quite a stir in the investment community. Twenty two thousand corporations filed for an extension, far more than the normal "few thousand" according to Senate Leader Bhatia. Bhatia explained that the Treasury has called the top 100 filers that filed for extension and accounted for 80% of the shortfall which will be collected.

In December, the gov't passed legislation allowing for a gross sales tax and complicated the new tax by combining it with an AMT tax. The CPA community did not have time to file the necessary reports. Frustrated with the higher and more complicated taxes, corporations filed extensions without payment. Legislators have eliminated the AMT tax and confusion for 2015.

Act 154, initiated in 2010 and extended thru 2017 is a revenue source that deserves some attention. Big picture, most foreign multinationals operating in Puerto Rico had been given lucrative local tax breaks to lure them to the Island. The previous Governor (Fortuno) implemented a large income/corporate tax cut and needed to replace the lost revenues. In his mind, multinationals were benefiting from PR but not paying any taxes. He introduced Act 154 which acts like a 4% income tax on multi nationals; it is not an income tax, but looks like one and because it looks like one it is legal (for now). In reality, the tax is an excise tax charged when multinational companies export the goods produced in PR to their operations outside of PR.

Currently, the tax is "creditable" and multinationals can use the tax to offset federal income taxes so there is no economic cost. The IRS ruled that if the tax deduction were to be eliminated, the change would be proactive only. It is clear, that this tax ruling is one of the ways the US Government is subsidizing Puerto Rico.

Expenses: Most private economists and even many gov't officials believe that gov't is too big and that the excesses need to be eliminated. To that end the Fiscal Sustainability Act was passed last week which will enable the gov't to amend wasteful labor contracts.

In the United States, the gov't employs approximately 15% of the labor force. In Puerto Rico approximately 20% of the work force is directly employed by the gov't and another 5% is employed by public corporations. Naturally, the biggest General Fund expense is payroll and when we include health and pension benefits, these costs are over 50% of the budget.

The numbers in the table below are from the GDB 2015 estimates and are in billions.

To contain these costs, the gov't needs to continue reducing headcount by consolidating their agencies. We believe another 50,000 gov't jobs need to be trimmed, school systems need to be consolidated, teacher's pension reform completed, and the public agencies need to be streamlined or privatized.

All of the above are being addressed; 25 gov't agencies are being consolidated into one, unused schools are being closed and consolidated, teacher's pension reform is being negotiated, and the agencies are being consolidated and made more efficient.

Here are some specific examples; the Mass Transit Authority is being created which will consolidate mass transit assets from Highway Trans Authority, Metropolitan Bus Authority, and the Maritime Transportation Authority. The Fiscal Sustainability Act was passed last week which will allow the gov't to break excessive labor contracts. Current talks in the legislature revolve around restructuring the public unions. Many politicians we spoke to on our trip indicated that the public corporations would operate far more efficiently with private owners and management.

What about the bonds? We believe that Cofina and GO credits are safe and the willingness to protect the bond holders is high.

We see the coverage for the outstanding senior Cofina bonds increasing. Currently 1.3 billion in taxes are collected. The senior debt service is now 225 mlln per year and increases to 1.2 billion per year in 2057. Even assuming no inflation (higher inflation will increase collections) and no growth, the senior bonds are covered.

Most analysts believe that only a fraction of the taxes are actually collected. This was confirmed by the President of the Treasury. He explained that taxes are collected at point of sale, so an independent brick layer could avoid paying taxes by buying his bricks directly at the port as opposed to purchasing from Home Depot. In addition, there are many goods that are exempt from SUT taxes, baby goods for example. Unfortunately, some importers make a living hiding taxable products "behind the baby diapers".

The Legislature has already passed Law 40 which changes the way SUT taxes are collected. Beginning on July 1, the SUT taxes will begin being collected like a VAT tax or at every point in the chain, starting at the ports.

Assuming the SUT was 10%, it would work like this, the Baker buys a bushel of wheat from the Farmer for 100 dollars plus 10% tax or 110 dollars and the Farmer pays the 10 dollars to the gov't. The Supermarket buys the bread from the Baker at 150 dollars plus 10% tax or 165 dollars. The Baker keeps the 10 dollars he paid to the Farmer and pays 5 dollars to the gov't. The Consumer pays 200 dollars plus 10% tax or 220 to the Super market. The Supermarket keeps the 15 dollars he paid to the Baker and pays the gov't 5 dollars. At the end of the day, the gov't has collected 10 dollars from the Farmer, 5 dollars from the Baker, and 5 dollars from the Supermarket for a total of 20 dollars or 10% of the final sale price.

The beauty about this system is that the Baker and the Supermarket are incentivized to collect the taxes so that they can reimburse themselves for the taxes they paid. In addition, since the taxes are collected at each stage of the sale, the gov't will receive tax revenues sooner.

In addition, the intent is to expand the base so that there are no exempt items and no opportunity to hide the taxable goods "behind the baby diapers"

Some analysts believe that only 60% of the SUT taxes are being collected. If this rate increases to 80%, SUT tax collections could increase by 300 to 500 million per year. The gov't has projected a 170 mlln increase in collections in their 2015 budget assumptions.

In terms of claw back concerns, we met with ex GDB president, Jorge Irizzary, who designed the COFINA structure and we met with Fiddler Gonzalez, the law firm writing the documents for the upcoming third lien. The Fiddler counsel was adamant that the COFINA collections never hit the General Fund so there was "nothing to claw back".

In terms of the legality of COFINA receiving part of the tax, Jorge made an interesting point. He explained that COFINA was created to pay down Public Building Authority debt. In his mind, COFINA received the SUT but also inherited the debt so he did not buy the argument that the SUT taxes were at the expense of the General Fund and somehow illegal; he believed that since COFINA inherited the debt that the General Fund benefited.

In terms of the GO debt, almost everyone we talked to, including the politicians reminded us over and over that the GO debt service had senior and priority claim on the General Fund; before pensions, police, fire etc. To that end, debt service is approximately 1 blln per year on outstanding debt as compared to the 9.6 blln in revenues budgeted for fiscal 2015.

There are many Wall Street analysts that believe there will be a "holistic" restructuring of Puerto Rico debt which would include the GO debt. The on Island politicians, lawyers, and economists all looked at us like we were from a different planet when this was discussed. Two thirds of the popular vote is needed to amend the constitution and it became very clear to me that the GO debt service will be protected. The willingness to pay and the Constitutional protection are strong security for these bonds.