We have had a lot of clients

ask about repo and repo rates. This note is an attempt to explain the basics of

the repo market and perhaps offer some insights as to what the repo rate

volatility is suggesting.

We do believe that the Fed is on top of this and is providing ample liquidity

to financial institutions to fund themselves. We do not necessarily think that

repo rates will skyrocket, and the world will come to an end.

We do believe, however, that primary dealers and banks (financial institutions)

are heavily levered and will continue to be heavily levered as the US Govt

racks up larger and larger deficits and Corporations and Municipalities

continue to issue more debt. As liquidity providers, these financial

institutions hold some of this debt on their balance sheet until it is

distributed to end buyers and they use the repo market to finance these

positions.

Our concern is that these financial institutions are in a weak position to

handle rate volatility, especially higher rates. More repo volatility and

negative headlines could result in outflows out of MMKT Funds. MMKT Funds can

initiate gates and even charge liquidity fees. If this is a concern, we would

suggest that clients limit their exposure to co-mingled funds (ie mmkt funds).

What is Repo?

Repo is another term for

Repurchase Agreement. In simple terms, a repo is a collateralized loan.

The lender exchanges cash for a like amount of collateral. In most cases, the

collateral is Treasury or Agency securities but can also be Mortgage and Corporate

securities.

As an example, Counterparty A

(lender) may lend 10 mlln of cash to Counterparty B (borrower). In exchange for

the cash, Counterparty B puts up 10 mlln worth of collateral to secure the

loan. Counterparty B agrees to pay Counterparty A interest (repo rate) for the

borrow period. At the end of the borrow period, Counterparty B pays the

principal and interest back to Counterparty A and Counterparty A returns the

collateral to Counterparty B.

Why is Repo needed?

Most Banks, Primary Dealers,

and levered Funds own large amounts of Fixed Income securities; far more than

they can afford to pay for in cash. They need to borrow to pay for these

securities. They rely on the repo market to borrow money at very low interest

rates. In fact, a primary revenue source for many of these institutions is

to borrow money at a low rate and lend it at a higher rate; for their bond

positions, this is called positive carry. Negative carry occurs when repo rates

rise or the curve inverts.

Corporations and Individuals

often have excess cash that they need to lend/invest for short periods of time.

The repo market provides opportunities for them to make secure loans.

Corporations and Individuals often put their excess cash into MMKT Funds. Most

of these Funds are very active in the repo market.

How are Repo rates set?

Repo rates are set by the

supply and demand for money. When demand is more than supply then rates go

higher and vice versa. Since Banks can borrow from one another at the Fed Funds

rate, repo rates tend to gravitate to this level.

Risks of Repo?

If the borrower cannot repay

the principal and interest, they are in default, and the lender can sell the

collateral (securities) to recover the principal and interest owed. If the

collateral is worth less than the principal and interest, then the lender must

try to recoup any shortfalls in bankruptcy proceedings.

Why are repo rates

high?

Banks, Primary Dealers, and

levered mortgage Funds hold large amounts of bonds and need to borrow to pay

for them. As the US Government, Corporations, Municipalities, and

Households issue more debt, the primary dealers will likely have to hold more

debt on their balance sheet and will need the repo market to fund them.

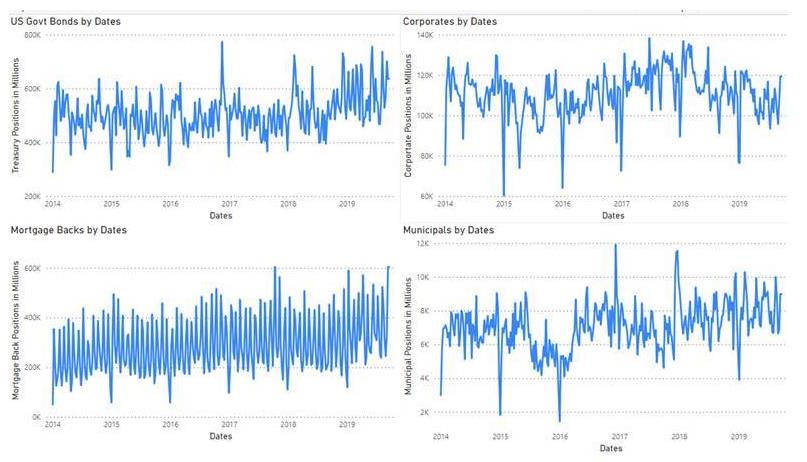

The charts below display how

many securities are held on Primary Dealer balance sheets as complied by the NY

Fed. Issuance from all sectors will pick up in the fourth quarter (especially

with lower rates) and these balance sheets will likely balloon further.

Traditional lenders currently

have little excess cash to lend primarily because of quarterly tax payments and

business needs surrounding trade and oil volatility.

In short, the demand for money far exceeds the supply.

What is the Fed doing?

The Fed has been conducting

overnight repos. In our supply demand model, they are providing more supply by

lending money to Banks and Primary Dealers in exchange for collateral (repos).

Starting last Tuesday

9/17/2019, the Fed has lent the following:

Tuesday = 53 blln

Wednesday = 75 blln

Thursday = 75 blln

Friday = 75 blln

Monday = 65 blln

Should we be concerned?

Repo rates very rarely spike

as high as they did this past week and it implies that Financial Institutions

are heavily levered and lenders particularly stingy about lending. All this

during a time when market volatility is increasing. Given their large balance

sheets, financial institutions may be more vulnerable to market volatility. Our

concern is that even the perception of a valuation/credit problem could limit

their access to the repo market as lenders will naturally gravitate to those

counterparties that are more secure. The Fed will likely ensure that these

institutions have access to repo, be we are uncertain what MMKT investors will

do regarding more negative headlines about the repo market.

Should you be concerned

about MMKT Fund exposure?

We do believe the Fed will

provide ample liquidity to the Repo markets and become the lender of last

resort. However, we do have some concern that we are starting a self-fulfilling

process where negative headlines spook lenders, they lend less (in repo) and repo

rates continue to be volatile, resulting in MMKT Fund outflows, more negative

headlines, more outflows etc. If too many MMKT participants want out at the

same time, then MMKT Funds may have to implement gates and/or liquidity fees.

We don’t believe this to be a base case scenario but we do recommend that

clients limit their exposure to co-mingled funds until the liquidity issues

subside.