|

Please wait while emails are

being processed and sent... |

Tax Advantaged Relative Value Fund: What We Like

by

Randy Jacobus

Tuesday, August 13, 2013

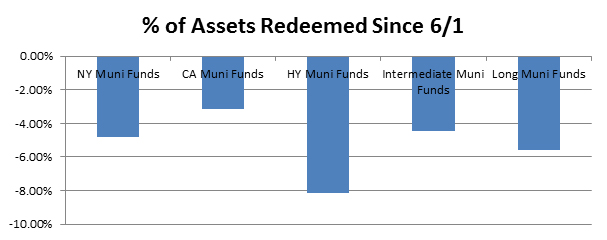

1) Long Duration and High Yield Muni Funds have had the most redemptions since the “Taper Talk” and therefore these sectors have seen the most aggressive selling.

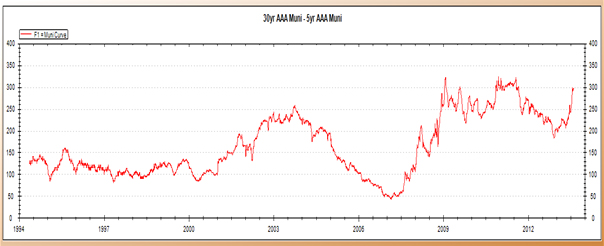

Curve is extremely steep making long end look cheap.

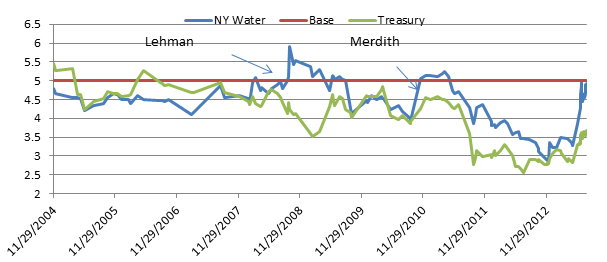

At 5% yields, long tax exempt rates are back to historic levels, unlike Treasuries.

2) Relative to long duration Treasuries and Corporates, Municipals look very cheap.

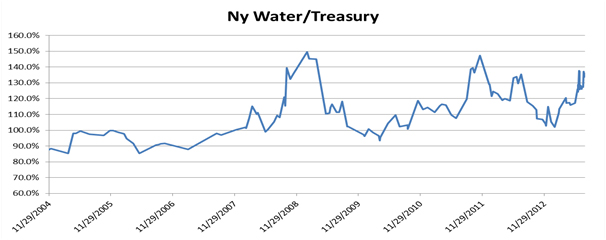

We are approaching ratio (Muni rate divided by Treasury rate) levels that we saw during the crisis. In fact, the Gulf Zone Tax Exempt Bonds backed by Marathon Oil are now trading cheaper than the Taxable Marathon Oil Bonds. This makes no economic sense and will change.

3) We short long duration Taxable Assets to neutralize the duration risk. If interest rates go up we will make money on our hedge.

4) We believe the table is set for Municipal Bond outperformance.

- High absolute rates will attract retail buyers

- High tax exempt rates relative to corporate rates will attract “cross-over” buyers who will sell corporates to buy municipals.

- In June, July, and August over 100 blln in reinvestment proceeds are being created by maturing municipal bonds and municipal coupons.

- Increasing local tax collections are helping improve State and Local credits.

- High State and Federal Income taxes are making the tax exemption more valuable.

5) If the relationship between tax exempt bonds and the taxable bonds normalizes to equal yields, the TARV return profile looks very attractive.

Structured holdings = 50% return = 50% of portfolio = 25% return allocation

Liquidity holdings = 15% return= 50% of portfolio = 7.5% return allocation

Total on hedged portfolio = 25% + 7.5% = 32.5% if Muni yields and Treasury yields converge.

6) Fund does not use leverage to buy Municipal Bonds

Municipal Markets