But what it is ain't exactly clear...Buffalo Springfiled.

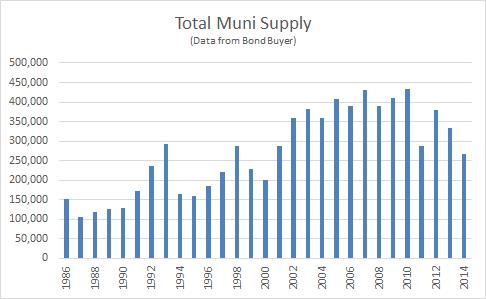

Even as rates fall, the amount of new issuance continues to run at a very slow pace. As you can see from the bar chart below, total muni issuance is on pace to reach 260 blln this year which is down significantly from 335 billion in 2013 and 380 blln in 2012.

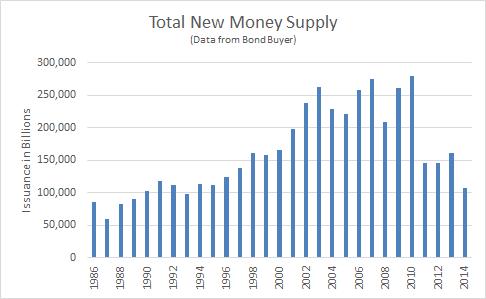

More significantly, the amount of "New Money" issuance is falling dramatically too. New monies are used to fund new infrastructure projects and expanding localities. With a stronger economy and increasing tax receipts we expected New Money issuance to increase.

It "isn't exactly clear" why this new money issuance has not increased. We believe there are a number of contributing factors;

1) Voters are not in favor of higher taxes and spending initiatives.

2) Local issuers are struggling to keep up with escalating post employment benefits of their govt employees which is crowding out new debt costs.

3) A larger percentage of new issuance is being done directly to Banks and is not being issued in the public markets.

Keep in mind that there will be approximately 200 blln in municipal bonds maturing this year and over 100 blln in muni cpns paid; creating almost 300 blln in potential reinvestment proceeds. Relative to only 100 billion in new money issuance we could have an extreme shortage of product for investors to buy.